CRM Stock: Salesforce’s Growth Prospects and AI-Driven Opportunities in 2025

Salesforce’s CRM stock has long been a leader in the cloud software sector, capturing the attention of investors and analysts alike. As we move into 2025, market observers are closely watching how Salesforce’s focus on artificial intelligence and its expanding Sales Cloud platform could shape the company’s growth and, by extension, CRM stock performance.

Why Salesforce Remains a Top Contender in the CRM Space

Salesforce holds a dominant position in the customer relationship management market. This strength is not just historical; it’s reflected in the company’s ongoing ability to innovate and evolve. Salesforce’s business model, built largely on recurring subscription revenue, has provided stable growth and made CRM stock a reliable option for many portfolios.

One standout contributor to its future is the adoption of advanced AI features. According to analysts, Salesforce is leveraging products like Agentforce to streamline workflows, automate tasks, and boost productivity. In fiscal year 2025, for instance, Salesforce closed nearly 5,000 Agentforce transactions, with more than half being paid deals. With over 150,000 global customers, the runway for additional growth looks substantial. For a deeper dive into the company’s expanding AI capabilities and the positive impact on efficiency and margins, see Salesforce's AI-Driven Comeback: A Buying Opportunity After the Tariff-Induced Sell?Off.

Analyst Outlook: What Experts Are Saying About CRM Stock

CRM stock continues to attract praise from leading analysts. Bank of America Securities, for example, has reiterated a Buy rating on Salesforce, with a projected 27% upside from current levels. Their optimism is founded on factors such as Sales Cloud’s dominance, the integration of AI tools, and business intelligence features that position Salesforce to capture further market growth. According to recent reports, products like Industry Cloud and Revenue Cloud, along with the company’s growing user base, are accelerating expansion. For more details on this bullish analysis, check out TipRanks’ coverage.

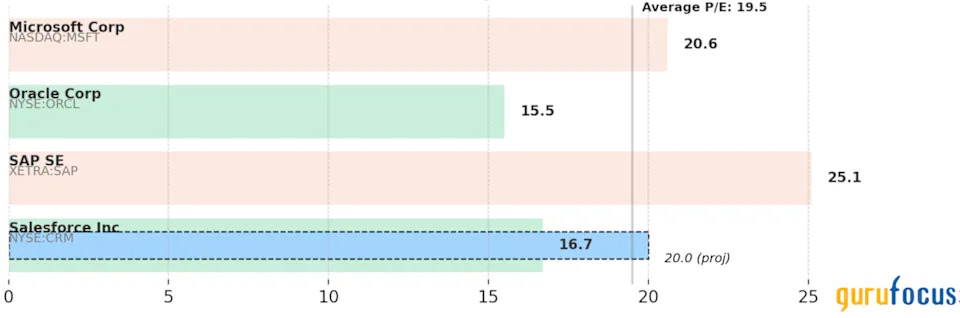

Additionally, industry insights show that CRM stock holds a Moderate Buy consensus on Wall Street, with a price target suggesting around 26% upside potential from recent levels.

Key Trends Powering CRM Stock’s Performance

Several industry trends favor Salesforce and CRM stock, including:

- Increased AI integration for automation and insights.

- Recurring subscription revenue leading to stable earnings.

- Strategic partnerships with leading cloud providers.

- An expanding ecosystem that encourages upselling and customer retention.

The rise of agentic AI solutions is particularly noteworthy. Salesforce’s Agentforce and related offerings are expected to benefit as the AI market could grow from $5.4 billion in 2024 to more than $52 billion by 2030.

Conclusion: Is CRM Stock a Buy for 2025?

Salesforce’s momentum, driven by its AI initiatives and strategic expansion of the Sales Cloud, makes CRM stock a compelling choice as we head into 2025. Analysts remain optimistic about its growth prospects, highlighting both innovation and market dominance as strengths. For investors seeking a tech leader with sustainable upside potential, CRM stock stands out in today’s dynamic software landscape.

For further reading on CRM stock’s position in the software market, visit Barrons.com.