Intel Stock Outlook: Current Performance, Challenges, and What Investors Should Know

Intel stock has remained a hot topic among investors and tech watchers alike. The well-known chipmaker, once a dominant force in the semiconductor industry, has faced unique challenges in recent years. With new leadership, renewed strategies, and ongoing debates about its future, understanding the current state of Intel stock is essential for anyone interested in tech investing.

How Has Intel Stock Performed Recently?

Over the past few years, many semiconductor stocks have achieved impressive gains, fueled by the artificial intelligence (AI) revolution. However, Intel has not matched the parabolic rises seen at its rivals. In fact, recent analysis points out that Intel stock has dropped more than 30% in the last couple of years, reaching levels not seen in over a decade.

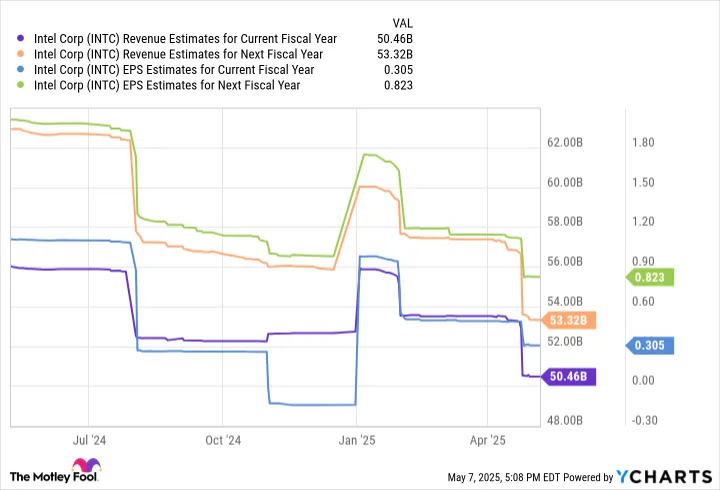

Wall Street's outlook remains cautious. While industry peers like Nvidia, Broadcom, and Taiwan Semiconductor have soared, Intel has lagged behind. Much of this underperformance is tied to difficulties in its foundry business, which posted significant operating losses last year. Despite a small revenue uptick in early 2025, future growth remains uncertain.

Leadership Changes and Strategic Shifts

To address ongoing challenges, Intel’s board appointed Lip-Bu Tan as the new company leader in March 2025. Tan is known for his success at Cadence Design Systems, where he oversaw incredible stock growth. According to a detailed TipRanks analysis, Tan’s arrival has sparked hope among investors that Intel can restore its competitive edge.

Tan’s early moves include transforming Intel into an engineering-focused company and announcing sweeping cost reductions. These efforts have included workforce cuts and a renewed focus on efficiency. Some analysts believe a potential spin-off of Intel’s foundry business could significantly boost shareholder value in the coming years.

What Are the Prospects for Intel Stock Investors?

Opinions on Intel stock remain divided. Some investors view Tan’s leadership and ongoing restructuring as reasons for optimism. Others note that, despite recent changes, Intel has much ground to regain against industry leaders capitalizing on AI trends.

Analyst consensus at present is largely neutral. Most suggest holding Intel stock, as seen in recent investor insights. Still, the evolving strategy and market developments will be critical to monitor for anyone considering an investment in Intel.

Conclusion: Should You Consider Intel Stock?

Intel stock represents a unique situation in today’s technology market. The company’s established history and recent leadership shake-up offer potential upside, especially if current strategies succeed. However, investors must weigh ongoing risks and industry shifts carefully. For deeper insights, review this comprehensive analysis on whether Intel stock is a buy right now and stay tuned to further updates as Intel forges its next chapter.