Nvidia Stock Price: Latest Trends, Predictions, and What Investors Need to Know

The Nvidia stock price continues to captivate investors and analysts as the company remains a driving force in the artificial intelligence (AI) and semiconductor industries. With its rapid innovation and market leadership, Nvidia (NASDAQ: NVDA) is at the center of significant discussions around growth, volatility, and future prospects. Let’s look at the latest trends, expert predictions, and key factors that influence the Nvidia stock price.

Recent Performance of Nvidia Stock Price

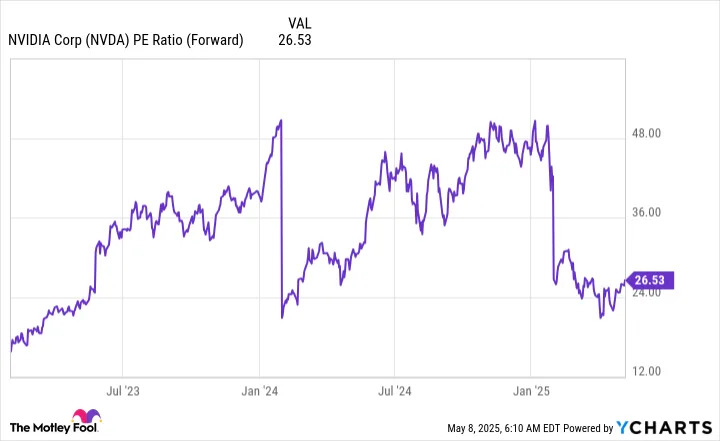

Nvidia’s shares have experienced notable fluctuations in 2025. After a remarkable rally in previous years, the Nvidia stock price has pulled back nearly 19% in the first five months of 2025, reflecting broader market volatility. Short-term headwinds, including tariff uncertainties and macroeconomic turbulence, have put pressure on the stock. Yet, many analysts suggest that core fundamentals remain strong. Nvidia's business, especially its data center segment, continues to drive the majority of its revenue—about 90%—highlighting sustained demand for its products.

Is Now the Right Time to Buy Nvidia?

History shows interesting patterns for Nvidia stock. According to a detailed analysis on Yahoo Finance, Nvidia’s shares have rallied significantly after its first-quarter earnings reports in both 2023 and 2024. In each case, the stock rebounded strongly in May, fueled by robust financial results and ongoing confidence in AI infrastructure investments.

However, not all forecasts are bullish. TipRanks notes that while Nvidia stock currently appears undervalued relative to its long-term growth prospects, recent growth slowdowns and increasing external risks, such as U.S.–China trade tensions, have led some investors to adopt a more cautious stance. The company's growth narrative is intact, but short-term volatility and dips below long-term moving averages make timing for entry a challenging decision.

Expert Predictions and Analyst Ratings

Despite the current downturn, most Wall Street analysts remain optimistic about Nvidia’s long-term trajectory. Out of 40 analysts, 34 currently rate Nvidia a "Buy," and the average price target sits notably higher than the present level—suggesting considerable upside. Confidence stems from Nvidia's leading position in AI hardware and growing revenues, particularly in sectors demanding high data center performance. Even so, experts caution that the stock's premium valuation demands continued innovation and earnings growth to justify further gains.

On the flip side, certain analysts warn that multiple headwinds could limit future gains. A recent piece from The Motley Fool highlights how the first Wall Street sell rating could signal that more cautious sentiment is growing, especially if post-earnings results on May 28 disappoint.

Key Factors to Watch

Several important factors may impact the Nvidia stock price in the coming months:

- AI and Data Center Demand: Nvidia's dominance in AI chips remains a strong tailwind. Steady demand from leading tech companies supports overall revenue growth.

- Geopolitical and Economic Uncertainty: Trade policies, particularly regarding tariffs, and general economic slowdowns introduce risks that may trigger further volatility.

- Technical Indicators: Monitoring the stock’s movement relative to its 200-day moving average and volatility metrics can help investors make better timing decisions, as discussed in this TipRanks article.

Conclusion: What’s Next for Nvidia Stock Price?

Nvidia's stock price remains one of the most closely watched in today’s market. While some short-term uncertainty persists, the long-term case for Nvidia is underpinned by technological leadership and sustained demand for AI and data center products. Investors should closely follow upcoming earnings, global economic trends, and industry developments. If you’re considering investing, weigh the potential for high returns against heightened volatility and macro risks.

For more detailed analysis, check out these resources:

- History Says Now Is the Time to Buy Nvidia Stock (Yahoo Finance)

- Discounted Nvidia Stock (TipRanks)

- Prediction: Nvidia Wall Street Sell Rating (The Motley Fool)

As always, conduct your own research and consult financial professionals to tailor your investment strategy.